Similar forms

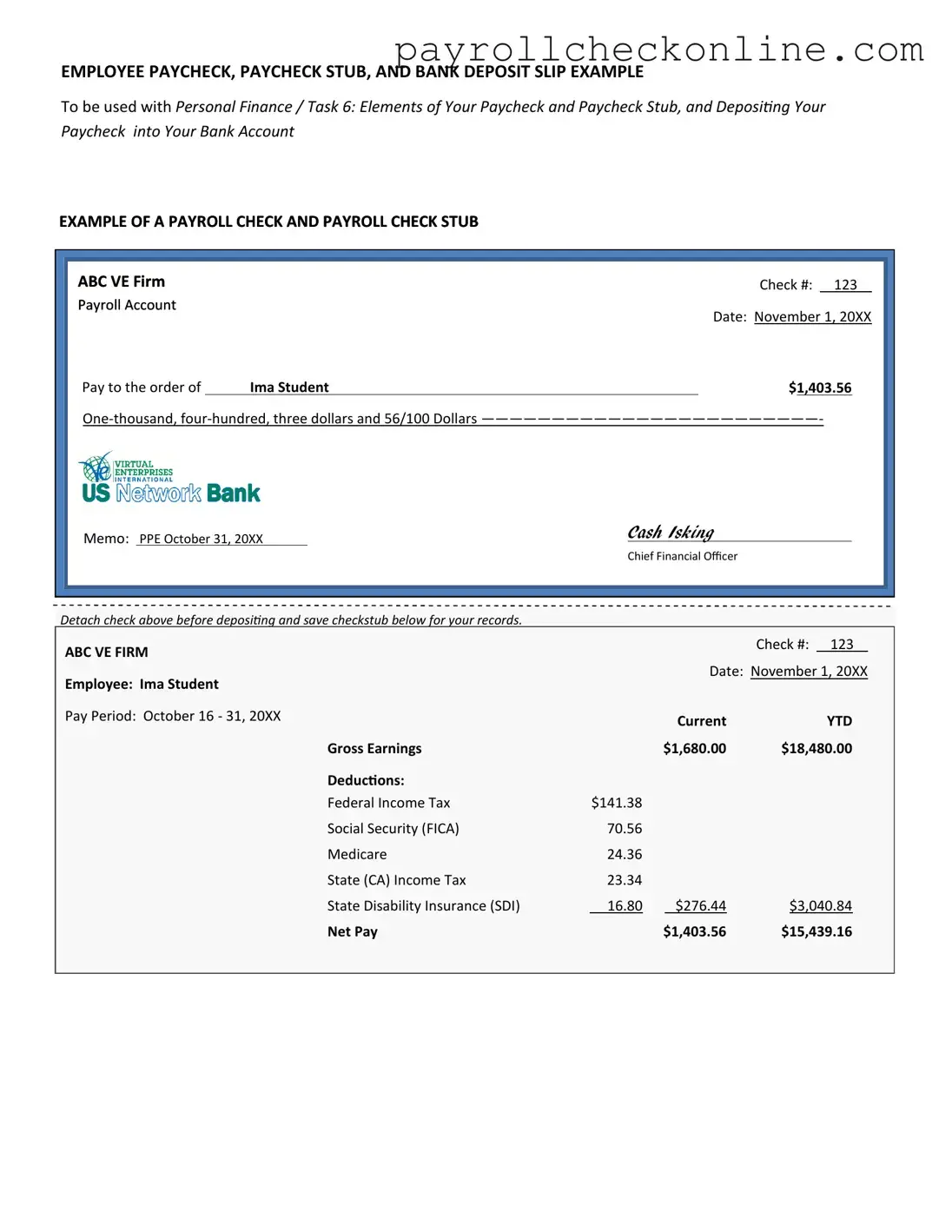

The Payroll Check form serves as a vital document in the payroll process, ensuring that employees receive their wages accurately and on time. One document similar to the Payroll Check form is the Pay Stub. A pay stub provides a detailed breakdown of an employee's earnings for a specific pay period. It includes information such as gross pay, deductions, and net pay, allowing employees to understand their compensation and any withholdings. Both documents are essential for record-keeping and transparency in the employer-employee relationship.

Another document that shares similarities with the Payroll Check form is the Direct Deposit Authorization form. This document allows employees to authorize their employer to deposit their wages directly into their bank account. Like the Payroll Check form, it is crucial for ensuring timely payment. While the Payroll Check form is used for physical checks, the Direct Deposit Authorization form streamlines the payment process, reducing the need for paper checks and enhancing convenience for employees.

The W-2 form is also comparable to the Payroll Check form. Issued annually, the W-2 summarizes an employee's earnings and tax withholdings for the year. While the Payroll Check form reflects individual pay periods, the W-2 provides a comprehensive overview of an employee's financial information for tax purposes. Both documents are essential for accurate reporting and compliance with tax regulations.

In addition to these, the Time Card or Time Sheet is another document that bears resemblance to the Payroll Check form. A time card records the hours worked by an employee, serving as the basis for calculating wages. This document is often submitted alongside the Payroll Check form to ensure that employees are compensated for the correct amount of time worked. Accuracy in timekeeping is crucial, as it directly impacts the payroll process.

For those involved in transactions involving firearms, it's essential to understand the various legal documents required, including the Bill of Sale for a Gun, which records the transfer of ownership and serves as proof of the transaction.

The Payroll Register is another document that aligns closely with the Payroll Check form. This report summarizes the payroll for a specific period, detailing each employee's earnings, deductions, and net pay. The Payroll Register acts as a comprehensive record that supports the information presented in the Payroll Check form. Both documents are essential for maintaining accurate payroll records and ensuring that employees are paid correctly.

Lastly, the Employee Earnings Record is similar to the Payroll Check form in that it tracks an individual employee's earnings over time. This document records each pay period's wages, deductions, and year-to-date totals. It serves as a historical record for both the employer and employee, providing valuable information for financial planning and tax reporting. Like the Payroll Check form, it plays a critical role in the overall payroll process.